Trading Brief for Tesla - How did we make profits?

- Strats Team

- Oct 27, 2024

- 10 min read

In this brief, we will explore recent developments with respect to the darling of Wall Street right now, the stock of Tesla, Inc. In extension to our earlier trading briefs, we intend to focus more on the stock perspective itself rather than the entire market perspective. We will talk about what has happened, what will happen, and what should be our next set of future actions to insulate ourselves from market volatility and ride the gains like a professional trader. Let us get into it.

We sent out trading alerts for multiple positions we took since last month in this underlying. We have been constantly advocating for long exposure in Tesla since the end of last quarter. We will talk about the reasons why we did so.

Briefing Date: Oct 26, 2024

Market Focus: Equities & Options (US)

Time Horizon: 6 months to 1 year for LEAPS (currently active)

Distribution Time: Post-Market

Market Overview

The Nasdaq rose on Friday, primarily due to gains in mega-cap technology stocks like Tesla, Amazon, Apple, and Microsoft, as investors reacted positively to Tesla's sales forecast and awaited earnings from major tech companies. Despite this, the broader market saw mixed results; the Dow Jones fell due to declines in banking and fast-food stocks, while the S&P 500 remained largely unchanged. The market's movement was influenced by rising Treasury yields, anticipation of upcoming employment data, and the potential impact of the U.S. presidential election.

Key Points:

Nasdaq Performance: Up 0.56% due to tech stocks, extending its weekly winning streak.

Market Trends: Dow and S&P 500 experienced declines; influenced by banking sector profits, fast-food issues, and broader economic indicators.

Economic Factors: Rising Treasury yields, upcoming economic reports, and the U.S. election are causing market volatility.

Corporate Developments: Tesla's surge, Capri Holdings' significant drop, and anticipation for tech earnings next week.

Investor Sentiment: Cautious but influenced by optimism around tech stocks and economic data suggesting a robust U.S. economy.

The market is navigating through a period of uncertainty with significant events on the horizon, including major tech earnings and critical economic data releases.

Globally, the most important news coming now as of this writing is the loss of the current coalition government since 2009 in Japan in their Sunday elections. This is a huge surprise to the markets, and therefore, we may expect the Bank of Japan's intervention may lead to volatile outcomes in both equity, debt, and forex markets. This could be cascaded to the Europe open and therefore to the US markets later in the day. We are prepared for any event as we constantly hedge our exposures.

Our current active trades are resilient and may need slight adjustments should there be a necessity and will be posted in our community should actionable alerts be coming from our models.

This trading brief will go against our traditional template and will capture the timeline of market events and our actions that already happened in the last few days. Therefore, you will see charts at different time stamps and our actions are taken to summarize the asset behavior and our ever-dynamically changing market perspectives.

Trade 1 on September 26, 2024 - Bull Call Spread (Long)

Bull Call spread is a long trade where the position will appreciate in value when the underlying rises and depreciates when the underlying falls. This strategy can be deployed by both beginners and experienced traders to prepare and capture profits when the stock rises. This involves buying a Call Option that is near to the stock's price (ideally slightly above) and selling a Call option that is farther away from the stock price (above), both in the same series of expiration.

For example, we sent out an alert on September 26th for TSLA Bull Call Spread on November 15, +280c/-310c

It is to be read as In the option chain of Tesla's November 15 expiry, we buy a call option at 280 strike and sell another call option at 310 strike. We pay for the 280 call (also called Buy Leg or Long Leg) and receive credit for selling the 310 call (also called Sell Leg or Short Leg), forming a bull call spread combo position of options with both long and short legs.

This is a net debit trade because we pay more and receive less. This is still a great alternative to reduce the cost of buying an option as we sell a higher strike call for credit. So, the trade looks as follows.

Buy to Open Tesla Nov 15 280 Call (debit)

Sell to Open Tesla Nov 15 310 Call (credit)

Net debit paid to open this position: $8.25 /contract - meaning $825 for 1 contract.

This position is opened on the expectation that the stock will rise further leading into the major events of Robotaxi and Earnings in October. The below chart shows the price point on the day of September 26.

Important things to remember:

Theta: Time value erodes over time and options lose their value as expiration approaches. So, may be good for the sell leg, but bad for the buy leg.

Max profit is limited because of the sell leg above, so if the stock moves past the sell leg, the profits from the buy leg going deep in the money will be limited and capped from losses incurred by the sell leg.

Ideally, we want the sell leg to expire worthless and the stock to rise just until the sell leg, thereby pushing the buy leg deep in the money so we can get maximum profit.

Best to buy a 30-delta option leg and sell a ten-delta or lower option leg to have a low cost for a decent profit. Delta means how much the option price moves w.r.t the underlying, so for a stock spot price of 250, a 30 delta option would be roughly around 265-270 (just a bit higher) and a 10 delta option would be even more away, so the likelihood of touching that level is low, hence we sell farther.

Both options are traded on the same expiration series.

Let us take a look at the trade from the chart below. As you can see, the price closed at a resistance level on the daily chart and is about to reverse its trajectory. We still went ahead and bought this spread, knowing this was a very risky play. Why? Based purely on the fundamental expectation that the Robotaxi event is going to be successful and combined with the earnings. But, it turned out that the event was actually not well received by the market and the stock tanked a day later incurring a loss to this position.

So, how did we manage the position?

Chart

We know that the stock is powerful and has a lot of potential for the upside. So, we stayed in this position and closed our sell leg in profits (remember that stock fell down, so the sell leg 310 Call has about 90% unrealized profit). But, our long leg / buy leg at 280 Call is having a huge unrealized loss as well. So, a few days later, we averaged by buying two more of those 280 calls when the stock price was at the 219 level, making the total average cost of 280 calls 7.56.

We stayed in the position while everyone was panicking after the stock fell to 218 levels. We averaged the cost to $7.56, but it is still useless because the options are further out of the money as a 280 strike is less likely to be hit when the stock was trading at 218-219 levels, and the implied volatility has passed away after the Robotaxi event. (Implied volatility is just a fancy word for market participants' interest in those options when a big event is on the horizon, e.g., earnings, press release, dividends, product launch, etc. IV drops after the event has passed. IV causes the options prices to rise, and lack of IV means prices drop - good for sellers, bad for buyers.)

Earnings are just around the corner, so we deployed another trade. But first, we close this entire long position as a buyer and have turned ourselves into our traditional role of sellers of options.

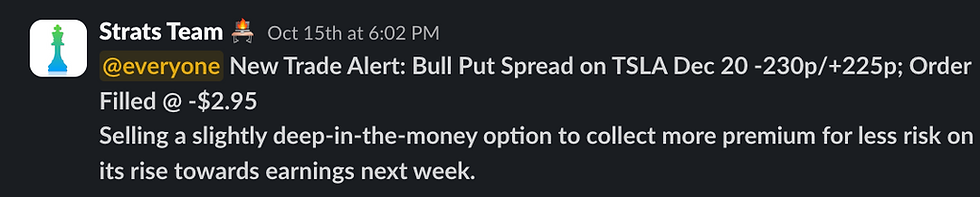

Trade 2 on October 15, 2024 - Bull Put Spread (Long)

We sold a bull put spread (check this explanation) for the Tesla December Series as shown below.

Why did we do that? Why did we sell December and give more time to this position as a seller? Don't the option sellers need less time and isn't it better to sell October itself?

Well, yes. Option sellers need less time as theta is their friend and time value erodes the options prices as time passes by and expiration gets closer. But, this is an advanced trading strategy not known by many traders. Not even on the internet you will find this strategy often, maybe very rarely mentioned by someone on Reddit, etc. Why? Because this is like entering an already losing position and turning it into a profit. We receive more credit for selling deep in-the-money options thereby reducing the margin necessary for opening this trade.

We got a credit of $295 per contract and this is necessary to offset the losses incurred earlier from our Bull Call Spread in anticipation of the rise of Tesla, which of course came later post-earnings.

Trade 3 on October 23, 2024 - Iron Condor (Neutral)

A day before the earnings, we also deployed an Iron Condor selling both call spreads and put spreads at the same time in the same expiry, here in our case, October 25, as the earnings were released post-market on October 23, so with just 2 days left these options will expire worthless if the price stays between the yellow bounds as shown in the chart below.

By now, we have both a Bull Put Spread which is a bullish trade (long), and an Iron Condor which is a neutral trade. The long exposure from the December Bull Puts protects us if the stock rises above the yellow bound upside.

Final Outcome

Tesla earnings results were a hit and the stock surged over 23% the next day on stronger-than-expected results in profit margins and a very strong future guidance. As always, the market adjusts the real value of an asset even though there may be short-term disturbances created by other external factors.

Our expectations turned out to be right and we made an overall net profit that even covered our losses initially made from the Bull Call Spread November 15 +280c/-310c, as the stock surged upwards past the strikes of the Bull Put Spread sold for the December series. Coming to the Iron Condor, the lower bounds naturally eroded in value and the upper bound was threatened we exited that at the market open, along with our Bull Put Spread to book profits and reduce our exposure in the Tesla stock. Here is an overall profit and loss overview for these trades.

The whole point of establishing these trades is our opinion of Tesla stock and its potential for the upside. Is it finished here? No, we acquired LEAPS for January 2026 later and are expecting the stock to hit the high 300s very soon and potentially 400 by the year-end of 2025.

Warren Buffet Favorite - LEAPS (Long Term Equity Anticipated Securities)

Tesla Jan 2026 400 Call Bought at $3155

Chart of Tesla after earnings results on October 25, 2024

The reasoning mentioned in the chart explains why we acquired LEAPS on Tesla. If you had read our strategy guide, "The Retail Core," which explains all important chart patterns, you would know the potential outcome of this pattern shown above once the price had a breakout outside of the wede upside. Please get yourself a copy here if you haven't. Feedback is welcomed.

Comprehensive analysis of Tesla, Inc. and why we bought more

Tesla's Financial Outlook

The recent third-quarter results show an improvement in automotive gross margins to 17.1% from 14.9%, alongside a reduction in the cost of goods sold per unit by 6.4% year-over-year. hashtag#Elon Musk's optimistic prediction for fiscal year 2025, expecting a 20-30% increase, seems supported by strong order trends in the fourth quarter. This development suggests that financial analysts will need to revise their earnings per share (EPS) projections for FY25 to reflect these enhanced figures.

- Personal FY24 EPS estimate: $2.40, compared to Wall Street's (WS) $2.38.

- Personal FY25 EPS estimate: $3.40, against WS's $3.20.

Following the third quarter's surpassing of expectations by $0.12 per share, FY24 adjusted EPS estimates are now at $2.38. However, the significant adjustment opportunity lies in FY25. Current forecasts only slightly increase FY25 EPS by $0.10 per share to $3.20, with a modest 14% increase in sales volume expected, contrasting with Musk's guidance of 20-30%. Moreover, analysts are projecting an automotive gross margin excluding regulatory credits of just 16.1%.

If we adjust for an additional 10 percentage points in volume growth (reaching 24% year-over-year) and increase the automotive gross margin to 17.1% (from 16.0%) for FY25, my EPS estimate rises to $3.40, which I anticipate Wall Street will soon adopt. Currently, WS's FY25 adjusted EPS stands at $3.20, which I believe underestimates the potential by $0.20.

As projections for sales volumes and hashtag#automotive gross margins for FY25 are revised upwards, it's likely that Tesla's stock price will also see an increase.

Summary

Since we have made some profits in Tesla lately and have moved them to our LEAPS for January 2026, we intend to exit only if it is really necessary. Meaning that the longer we wait, the better it is for the stock to realize its maximum potential. Should there be a Trump win on November 5th, 2024, election night, Elon Musk will benefit immensely from his close support to the new administration, and therefore, we don't see the headwinds he has seen lately with respect to his companies. Particularly in a low interest rate environment, the stock has more potential for the upside with its new portfolio of products such as RoboTaxis, Full Self Driving (FSD), and Optimus robots bringing in the most revenue since Tesla is an AI company with massive amounts of the training data and infrastructure necessary for their maneuvers seen lately with respect to his companies. Particularly in a low interest rate environment, the stock has more potential for the upside with its new portfolio of products such as RoboTaxis, Full Self Driving (FSD), and Optimus robots bringing in the most revenue since Tesla is an AI company with massive amounts of the training data and infrastructure necessary for their maneuvers in the innovation for 21st century.

Closing Notes

This trade is valid only as long as the price doesn't move 3% - typically for a day or two. Very good for an entry on a pullback with an even lower cost. Don't consider the trade if the stock has moved beyond with an increased cost of over $4000 to open.

Trading Brief for Tesla

.png)

Comments